Book Review: What Do We Know and What Should We Do About Tax Justice

SouthViews No. 289, 30 June 2025

By Abdul Muheet Chowdhary

SouthViews No. 289, 30 June 2025

By Abdul Muheet Chowdhary

Mali’s Mining Shake-Up: Tax audits reveal massive revenue loss and lead to stringent policy changes

SouthViews No. 287, 28 April 2025

By Anne Wanyagathi Maina and Kolawole Omole

SouthViews No. 287, 28 April 2025

By Anne Wanyagathi Maina and Kolawole Omole

Review: Taxation and Inequality in Latin America: New Perspectives on Political Economy and Tax Regimes (2023)

SouthViews No. 274, 30 August 2024

By Abdul Muheet Chowdhary

SouthViews No. 274, 30 August 2024

By Abdul Muheet Chowdhary

Honduras’ Tax Justice Law: Increasing tax collection to achieve the SDGs without increasing tax rates

SouthViews No. 270, 26 July 2024

By Abdul Muheet Chowdhary, Kuldeep Sharma and Kolawole Omole

SouthViews No. 270, 26 July 2024

By Abdul Muheet Chowdhary, Kuldeep Sharma and Kolawole Omole

Implementing wealth tax and wealth redistribution in Sub-Saharan Africa

SouthViews No. 249, 30 June 2023

By Khanyisa Mbalati

SouthViews No. 249, 30 June 2023

By Khanyisa Mbalati

The United Nations Intergovernmental Process – An Opportunity for a Paradigm Shift

SouthViews No. 248, 31 May 2023

By Kuldeep Sharma and Raunicka Sharma

SouthViews No. 248, 31 May 2023

By Kuldeep Sharma and Raunicka Sharma

UN Model Tax Convention Article 26: Inequitable Exchange of Information Regime – Questionable Efficacy in Asymmetrical Bilateral Settings

SouthViews No. 247, 29 May 2023

By Muhammad Ashfaq Ahmed

SouthViews No. 247, 29 May 2023

By Muhammad Ashfaq Ahmed

Mejora la regla del nexo para una distribución justa de derechos fiscales a países en vías de desarrollo

SouthViews No. 220, 28 de junio de 2021

Por Radhakishan Rawal

SouthViews No. 220, 28 de junio de 2021

Por Radhakishan Rawal

South Asia and the Need for Increased Tax Revenues from the Digitalized Economy

SouthViews No. 234, 18 February 2022

By Abdul Muheet Chowdhary

SouthViews No. 234, 18 February 2022

By Abdul Muheet Chowdhary

Améliorer des règles du nexus pour une répartition équitable des droits d’imposition pour les pays en développement

SouthViews No. 220, 28 Juin 2021

Par Radhakishan Rawal

SouthViews No. 220, 28 Juin 2021

Par Radhakishan Rawal

The Place of Multilateralism in Tax Reforms: Exclusionary Outcomes of a Purported Inclusive Framework

SouthViews No. 230, 25 November 2021

By Alexander Ezenagu

SouthViews No. 230, 25 November 2021

By Alexander Ezenagu

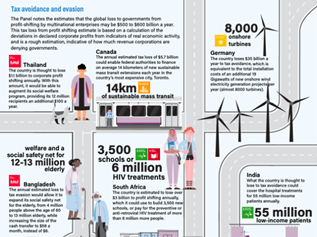

Ending Extreme Poverty by Ending Global Tax Avoidance

SouthViews No. 227, 29 September 2021

by Abdul Muheet Chowdhary

SouthViews No. 227, 29 September 2021

by Abdul Muheet Chowdhary

Financial integrity for sustainable development: Importance of developing country joint action on tax, corruption and money-laundering

SouthViews No. 223, 14 July 2021

By Dr. Ibrahim Mayaki

SouthViews No. 223, 14 July 2021

By Dr. Ibrahim Mayaki

Improve nexus rule for fair distribution of taxing rights to developing countries

SouthViews No. 220, 28 June 2021

By Radhakishan Rawal

SouthViews No. 220, 28 June 2021

By Radhakishan Rawal

Opportunities and Challenges: Tax Cooperation and Governance for Asia-Pacific Countries

SouthViews No. 219, 31 May 2021

Sakshi Rai

SouthViews No. 219, 31 May 2021

Sakshi Rai

Redistributing Taxing Rights to the Global South through the Digitalized Economy

SouthViews No. 210, 30 November 2020

Carlos Protto

SouthViews No. 210, 30 November 2020

Carlos Protto

Taxing the Digital Economy to Fund the COVID-19 Response

SouthViews No. 196, 22 May 2020

Abdul Muheet Chowdhary and Daniel Uribe Teran

SouthViews No. 196, 22 May 2020

Abdul Muheet Chowdhary and Daniel Uribe Teran

India and recent updates on the OECD/G20 Inclusive Framework’s Two-Pillar Approach

SouthViews No. 191, 13 March 2020

Subhash Jangala

SouthViews No. 191, 13 March 2020

Subhash Jangala

Enabling and Benefitting from Tax Avoidance:

The Case of Canada in Africa’s Extractive Sector

SouthViews No. 89, 17 January 2020

Alexander Ezenagu, PhD

The Case of Canada in Africa’s Extractive Sector

SouthViews No. 89, 17 January 2020

Alexander Ezenagu, PhD